Did NASA Find Evidence of Life on Mars in 1976?

Joe Biden and Ukraine Explained

Hunter Biden’s Connection to Ukraine

It turns out, that Mr. Shorkin’s office was investigating a Ukrainian natural gas company called Burisma. Mr. Biden’s son, Hunter, served on Burisma’s board at the time. However, the Biden camp insists that Mr. Biden and his son never spoke about this and that it had no bearing on his action.Kate Bedingfield, a spokeswoman for Mr. Biden’s campaign, told the New York Times that that Mr. Biden undertook his effort to remove Mr. Shokin “without any regard for how it would or would not impact any business interests of his son, a private citizen.”

Further, it is not clear that Shokin’s investigation against Burisma was actually all that active. According to Politifact, there are conflicting reports. Some in Shorkin’s office say the investigation was dormant at the time. Burisma maintains that the threat of an investigation was merely a shakedown intended to solicit bribes from the company. Yet, in spite of the potential that Mr. Biden’s son might benefit, there was nevertheless ample justification for Mr. Biden’s push for Ukraine to fire him.Widespread Concerns About Shokin

The IMF, the U.S. and international partners all agreed the Shokin was a problem. It would be a mistake to extend load unless they could be confident that the state prosecutor would aggressively pursue corruption. In early 2016, International Monetary Fund chief Christine Lagarde said that “it’s hard to see how the I.M.F.-supported program can continue” unless corruption prosecutions accelerate. Also, after Ukraine’s parliament voted overwhelmingly to force Mr. Shokin out, Jan Tombinski, the EU’s envoy to Ukraine, praised the move as “an opportunity to make a fresh start.” He added that he hoped that Kiev would name a new prosecutor who will ensure that the prosecutor’s office “becomes independent from political influence and pressure and enjoys public trust.”The Bottom Line

There were legitimate reasons for Mr. Biden to push for Mr. Shokin’s ouster and international observers widely agreed that Shokin was not doing his job and was woefully corrupt. So, there is a plausible explanation for Biden’s action that doesn’t involve a corrupt motive. Further, there is no evidence that Mr. Biden intended to benefit his son. Yet, at the least his son’s business ties created the appearance of a conflict of interest. Mr. Biden should have been more cautious about the appearance of impropriety. Finally, Mr. Biden’s judgement in this matter is fair game for Trump’s campaign. It would be entirely appropriate for the Trump campaign to hire researchers to investigate Mr. Biden’s actions, much as Ms. Clinton and the Democrats did in 2016 to look into Mr. Trump’s ties to Russia. Still, this does not excuse Mr. Trump’s leveraging of public resources for personal political gain. Presidents must separate the duties of the office and their own interests. President Trump’s actions are a reminder of his continuing failure to understand the distinction.Is a Recession Coming? (with Neil Irwin)

Signs of Recession?

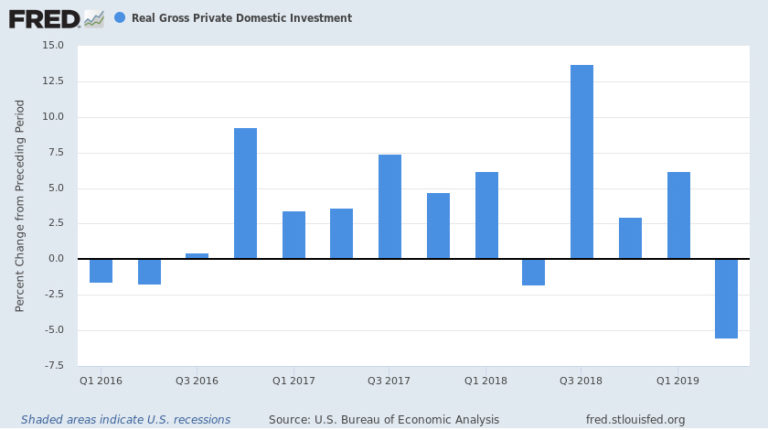

The U.S. economy is entering the longest expansion in history. But, how long can it last? The economic turmoil and relentless uncertainty of President Donald Trump’s mercurial trade policies are making businesses more reluctant to expand. Slowing growth in economies around the world isn’t helping either. New York Times Chief Economic Correspondent Neil Irwin joins the Axis of Reason podcast to discuss whether this all adds up to a recession on the horizon.

About Neil Irwin

Neil Irwin is a senior economics correspondent for The New York Times, where he writes for The Upshot, a Times site for analysis of politics, economics and more. He is the author of “How to Win in a Winner-Take-All World,” a guide to navigating a career in the modern economy, published by St. Martin’s Press.

Links

“Often, a recession results when some widely held belief about the world turns out to be false…. This time around, the belief in doubt is that the world will only become more stable and interconnected over time, and that trade, currency and diplomatic relationships can be counted upon.” – Neil Irwin: How the Recession of 2020 Could Happen (NY Times)

How to Win in a Winner-Take-All World

In How to Win in a Winner-Take-All World, Neil Irwin, senior economic correspondent at the New York Times, delivers the essential guide to being successful in today’s economy when the very notion of the “job” is shifting and the corporate landscape has become dominated by global firms. He shows that the route to success lies in cultivating the ability to bring multiple specialties together―to become a “glue person” who can ensure people with radically different technical skills work together effectively―and how a winding career path makes you better prepared for today’s fast-changing world. Through original data, close analysis, and case studies, Irwin deftly explains the 21st century economic landscape and its implications for ambitious people seeking a lifetime of professional success.

The Alchemists

Neil Irwin’s The Alchemists is a gripping account of the most intense exercise in economic crisis management we’ve ever seen, a poker game in which the stakes have run into the trillions of dollars. The book begins in, of all places, Stockholm, Sweden, in the seventeenth century, where central banking had its rocky birth, and then progresses through a brisk but dazzling tutorial on how the central banker came to exert such vast influence over our world, from its troubled beginnings to the Age of Greenspan, bringing the reader into the present with a marvelous handle on how these figures and institutions became what they are – the possessors of extraordinary power over our collective fate. What they chose to do with those powers is the heart of the story Irwin tells. Available on Amazon here.More From Roughly Explained

https://prodroughlyexp.wpengine.com/2019/07/unintended-consequences-how-tariffs-explain-lagging-business-investment/ https://prodroughlyexp.wpengine.com/2018/10/trump-trade-war-with-china-explained/Unintended Consequences: How Tariffs Explain Lagging Business Investment

Tariffs Breed Supply Chain Uncertainty

So, what’s going on? At least part of the answer may lie in another Trump administration economic policy working at cross purposes to the tax cuts. One possible explanation is uncertainty surrounding President Trump’s trade wars. As Trump’s trade war ramped up, business leaders grew more conservative about expanding. Federal Reserve Chairman Jerome Powell recently testified to Congress that concern that trade spats could disrupt supply chains is holding back businesses. “If you’re a manufacturing company in our economy, of any size, chances are pretty good that your supply chain goes across national borders,” Powell said in his testimony. “That supply chain is really part of how you do business, and you just assume that it’s working and you can focus on your clients. When your supply chain is called into question — we hear this a lot from businesses — when it’s called into question, you pull back.”Even companies that make things in America depend on parts imported from abroad. So, when tariffs rise on imported goods, the input costs of American-made products rise too.Tariffs meant to hold off foreign imports don’t necessarily help U.S. manufacturers. Even companies that make things in America depend on parts imported from abroad. So, when tariffs rise on imported goods, the input costs of American-made products rise too. Mr. Trump’s scattershot approach to trade policy exacerbates the problem. Mr. Trump announces new trade fights on Twitter seemingly at random. It’s hard for businesses to know what’s coming next. As a result, manufacturers can never be sure that Trump won’t hit the parts they depend on with tariffs. So, they conclude the risks of ramping up outweigh the potential benefits. This uncertainty was especially pronounced in the second quarter of this year. In May, President Trump threatened Mexico with tariffs unless it took more robust action to keep illegal immigrants from crossing its border with the U.S. This spooked American companies who depend on parts imported from Mexico.

Trade Wars and the Fed

Mr. Trump has demanded that the Federal Reserve cut interest rates at its next meeting. Analysts expect that they will do exactly that. The Fed holds its independence sacrosanct. They won’t cut rates just because Mr. Trump told them to do it. However, his actions on trade may have contributed to the Fed’s view that a rate cut is needed to shore up a weakening economy. “All Trump had to do was keep up geopolitical trade uncertainty for a while and he’d get the Fed to cut rates,” Ed Yardeni, president and chief investment strategist of Yardeni Research Inc. told Politico this week. Mr. Yardeni pointed out that Mr. Powell mentioned uncertainty surrounding trade as a headwind to economic growth eight times in his recent Congressional testimony. The problem with protectionist trade policies is that they come laden with unintended consequences. These can be hard to predict.Protectionist tariffs often undermine the very outcomes they are meant to accomplish. Increases in input costs for imported parts nullify the benefits to American firms. Further, when we slap tariffs on foreign products, foreign countries are likely to put tariffs on American products too. For example, after Trump levied tariffs on Chinese products, Beijing replied with tariffs of their own. Chinese tariffs on American soybeans have hit U.S. farmers hard. President Trump has spent billions to pay farmers for lost revenues. Trade protectionism is intended to bolster American businesses. But, recent events suggest that they can end up doing the opposite.What to Make of Mueller’s Testimony

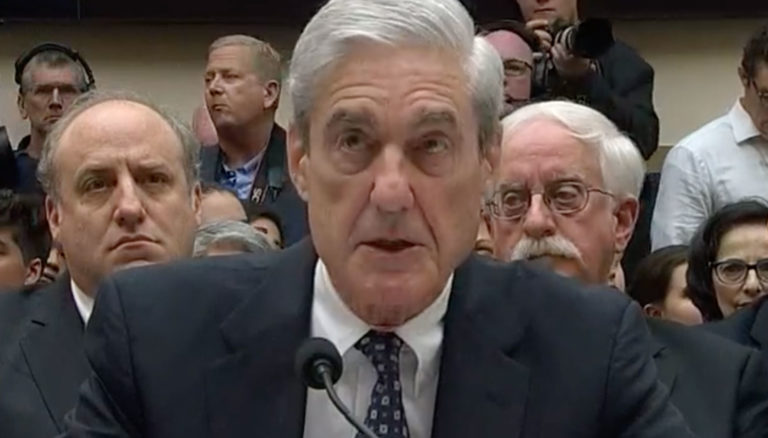

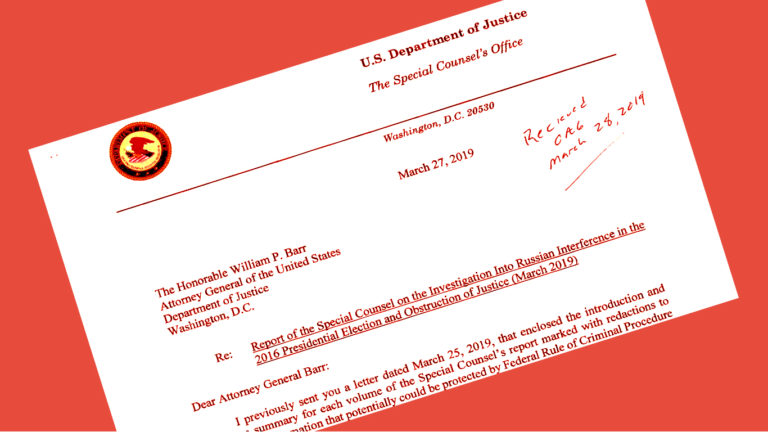

Neither side left satisfied. It appeared that’s exactly what Mr. Mueller intended. In this, he was a success.Democrats hoped Mr. Muller’s testimony would validate their argument that he would have indicted President Trump on obstruction of justice charges had Department of Justice policy permitted him to do so. Republicans hoped his testimony would further their efforts to portray the FBI’s investigation into potential ties between the Trump campaign and Russia’s election meddling as unwarranted, and born nefarious political motivations. Neither side left satisfied. It appeared that’s exactly what Mr. Mueller intended. In this, he was a success.

A Reluctant Witness

In often halting tones, Mr. Mueller delivered several hours of nothing particularly new. A straight-arrow g-man with little interest in the melee of politics, Mr. Muller was a polite but reluctant witness. His responses rarely extended for more than a sentence, often he offered just a word or two: “yes,” “no,” “that’s correct.” He spent more time asking preening lawmakers to repeat their questions than actually answering them. Democrats pressed their theories of how Mr. Trump criminally obstructed justice. Mr. Mueller shrugged. A Department of Justice Office of Legal Counsel opinion, which concluded that a sitting President could not be indicted, he said, precluded him from considering the question. Republicans pressed Mr. Mueller on what role the so-called Steele dossier, an opposition research document funded by Democrats, played in the opening of the FBI’s probe. Mr. Mueller simply said that it was before his time. “[T]hat part of the building of the case predated me by at least 10 months,” Mr. Mueller said in response to a question from Rep. Matt Gaetz of Florida.The Bombshell That Wasn’t

Democrats hoping for a bombshell had their hopes buoyed, only to be deflated again. When Rep. Ted Lieu laid out a theory for Mr. Trump’s criminal liability in obstructing justice, and asked Mr. Mueller if he would have indicted Mr. Trump had Dept. of Justice policy prevented him from doing so, he answered “that’s correct.” But, an hour later, in his opening comments to the House Intelligence Committee, Mr. Mueller clarified that Department policy prevented him from considering whether to indict the President, not that he would have done so in its absence. “I want to add one correction to my testimony this morning,” Mr. Mueller said referring to his earlier appearance before the House Judiciary Committee. “[Rep. Lieu] said, and I quote, ‘you didn’t charge the president because of the OLC opinion.’ That is not the correct way to say it. As we say in the report and as I said in the opening, we did not reach a determination as to whether the president committed a crime.”Mueller’s Testimony: The Bottom Line

Mr. Mueller’s Testimony revealed little we didn’t know about Mr. Trump and Russia. He was determined to stay within the bounds of the report. He grew considerably more animated when he spoke of the threat to American Democracy presented by Russia’s interference in the political process. Every American should be concerned about this. “Over the course of my career, I have seen a number of challenges to our democracy,” Mr. Mueller said. “The Russian government’s effort to interfere in our election is among the most serious…this deserves the attention of every American.”Robert Mueller might be the only man in Washington so thoroughly disinterested in the public spotlight.But, mostly Mr. Mueller seemed weary — and more enfeebled than we might have expected. Robert Mueller might be the only man in Washington so thoroughly disinterested in the public spotlight. He did his job. He did it well. Now, it seems, he’d prefer we all left him in peace.

How Washington Is Sowing the Seeds of Economic Calamity

About Aftermath

“In his most prescriptive book to date, financial expert and investment advisor James Rickards shows how and why our financial markets are being artificially inflated–and what smart investors can do to protect their assets…James Rickards, the author of the prescient books Currency Wars, The Death of Money, and The Road to Ruin, lays out the true risks to our financial system, and offers invaluable advice on how best to weather the storm.” – Penguin/Portfolio

“In his most prescriptive book to date, financial expert and investment advisor James Rickards shows how and why our financial markets are being artificially inflated–and what smart investors can do to protect their assets…James Rickards, the author of the prescient books Currency Wars, The Death of Money, and The Road to Ruin, lays out the true risks to our financial system, and offers invaluable advice on how best to weather the storm.” – Penguin/Portfolio

About James Rickards

Follow on Twitter

Jim Rickards: @JamesGRickards Taylor Griffin: @tgriffinnc Tyler Cralle: @tylercralle RoughlyExplained: @roughlyexplain https://prodroughlyexp.wpengine.com/2018/12/podcast-trump-and-the-economy-part-ii-with-jim-rickards/Why Was Twitter Down?

Twitter Down due to an “Internal Configuration Change”

Twitter blamed the outage on .” Thursday afternoon, the micro-blogging site posted a message to their status website indicating that they were “in An hour later, they identified the problem. “ Last month, a configuration error led to a major disruption of Google Cloud services, including YouTube, Snapchat, Venmo, and Gmail among others. Google’s head of engineering, Benjamin Treynor Sloss, explained what went wrong in a blog post:It took Google four and a half hours to fix the issue last month. This was in part because the outage affected tools Google’s engineers use to fix problems. However, Twitter was back to normal more quickly. Most users were able to access their accounts again by late Thursday afternoon. True to form, within minutes the sarcastic tweets followed.In essence, the root cause of Sunday’s disruption was a configuration change that was intended for a small number of servers in a single region. The configuration was incorrectly applied to a larger number of servers across several neighboring regions, and it caused those regions to stop using more than half of their available network capacity. The network traffic to/from those regions then tried to fit into the remaining network capacity, but it did not. The network became congested, and our networking systems correctly triaged the traffic overload and dropped larger, less latency-sensitive traffic in order to preserve smaller latency-sensitive traffic flows, much as urgent packages may be couriered by bicycle through even the worst traffic jam.

Had to resort to yelling my terrible opinions at strangers in public during the Twitter outage.

— Stephen Gutowski (@StephenGutowski) July 11, 2019

I bought 5 ugly hats I don't want while twitter was down

— christine teigen (@chrissyteigen) July 11, 2019

Twitter outage cause found pic.twitter.com/d8er1WrPq5

— miika (@MoonWolf95) July 11, 2019